Welcome to Part 2 of our debt series! In Part 1, Understanding Debt and Its Impact on Your Life, we have gone through understanding what debt is, the different types of debt, and how it affects your financial, emotional, and social well-being. Now that you have that foundation, we’re ready to take the next critical step on your journey toward financial freedom.

Today’s focus is on gaining clarity about your financial situation. It can be daunting to confront the numbers head-on, but this step is essential. Before we can start tackling your debt, we need to know exactly where you stand. By the end of this section, you’ll have the tools and strategies to create a complete financial picture, including income, expenses, debts, and cash flow.

1. Why Financial Awareness is Key

Understanding Financial Awareness:

Financial awareness is the cornerstone of successful debt management. Without knowing where your money is coming from, where it’s going, and how much you owe, it’s nearly impossible to make informed decisions. A lot of people are afraid to look too closely at their finances because they worry about what they’ll find—perhaps their debt is larger than they thought, or their expenses are out of control. This avoidance only deepens the problem, causing debt to spiral.

Financial awareness is not just about gathering facts; it’s about facing your financial reality with courage and clarity. It can feel overwhelming at first, but taking control of your finances is empowering. Once you know exactly what your situation is, you can begin to strategize and take meaningful steps toward solving your debt problem.

Common Roadblocks:

One of the biggest obstacles to financial awareness is avoidance. It’s natural to feel a sense of dread or anxiety when thinking about debt. Many people live paycheck to paycheck and avoid checking their bank accounts regularly, hoping that somehow things will work out. Unfortunately, this leads to poor financial decisions and even more debt accumulation. Overcoming this avoidance is the first victory on your journey to financial control.

How Financial Awareness Affects Debt Repayment:

By developing financial awareness, you’re empowering yourself to make smart decisions. Once you see where your money is going, you can start cutting unnecessary expenses, redirecting funds toward debt repayment, and planning for long-term goals. Without this clarity, you’re likely to continue overspending, under-saving, and relying on credit to make ends meet.

2. Gathering Your Financial Information

Creating a Financial Snapshot:

To begin assessing your financial situation, you’ll need to gather all the necessary information. This may seem tedious, but having everything in one place will provide a clear snapshot of your finances. Here’s what you’ll need:

List of Debts:

Collect statements for all your debts—this includes credit cards, personal loans, student loans, auto loans, and mortgages. For each debt, record the following details:- The total amount owed

- The interest rate

- The minimum monthly payment

- The payment due date

By organizing this information, you’ll have a clear view of what you owe and to whom. This is critical for creating a repayment plan and setting priorities.

Income Overview:

Your income is the foundation of your financial health. Write down all sources of income, not just your salary. Include any freelance or side gig income, rental income, dividends from investments, and any other streams of revenue. Be sure to calculate your net income, which is your take-home pay after taxes and deductions. Knowing how much money you have coming in each month is essential for creating a realistic budget and repayment plan.Tracking Expenses:

Expenses can be tricky to track because they fluctuate, and many small purchases go unnoticed. Start by gathering your fixed expenses—these are the consistent monthly payments like rent, utilities, car payments, and insurance premiums. Next, list your variable expenses such as groceries, dining out, entertainment, and clothing. Track your spending for at least a month to get a clear idea of where your money is going. Make sure to track all expenses no matter how small they are.You can use budgeting apps like Mint, YNAB (You Need a Budget), or even a simple spreadsheet to record your expenses. Categorize everything to identify patterns and see where you might be overspending.

3. Understanding Your Debt-to-Income Ratio (DTI)

Defining Debt-to-Income Ratio:

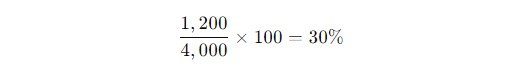

Your debt-to-income (DTI) ratio is a crucial metric used by lenders to determine how financially stable you are and how much debt you can handle. Essentially, it’s the percentage of your monthly income that goes toward servicing your debt. To calculate your DTI, use this formula:

For example, if your monthly debt payments total $1,200 and your gross monthly income is $4,000, your DTI would be:

What Your DTI Tells You:

A low DTI (below 36%) indicates that your debt is manageable relative to your income, and you’re more likely to be approved for loans or other forms of credit. A high DTI (above 43%) suggests that your debt is consuming too much of your income, leaving little room for savings or emergencies, and making it harder to qualify for credit.

Knowing your DTI helps you understand how close you are to being overwhelmed by debt. If your DTI is high, it’s a signal that you need to focus on reducing debt as a top priority.

4. Identifying Problem Areas

Pinpointing Financial Leaks:

Once you have a comprehensive view of your income, expenses, and debt, it’s time to identify the problem areas. These are places where your money is slipping away without you realizing it. Ask yourself:

- Are you spending too much on non-essentials like dining out, streaming services, or shopping?

- Are there unexpected or hidden fees that you’re paying every month, such as subscription services you no longer use?

- Are there any large, irregular expenses that aren’t accounted for in your monthly budget?

These financial “leaks” can add up quickly and are often overlooked in day-to-day life. For example, you might not think much about a $10 monthly subscription, but over the course of a year, that’s $120—money that could be applied to debt repayment.

Needs vs. Wants:

One of the most important distinctions to make when assessing your financial situation is between needs and wants. Needs are essentials like housing, utilities, and groceries, while wants are discretionary items like dining out, entertainment, and travel. Many people struggle with this distinction, especially in a culture that encourages consumption.

Take a close look at your expenses and ask yourself whether you’re spending on things you truly need or simply want. Cutting back on wants—even temporarily—can free up a significant amount of money to be put toward paying off debt.

5. Cash Flow and Budgeting

Understanding Cash Flow:

Cash flow is simply the money coming in versus the money going out. If you have more money coming in than going out, you have a positive cash flow, which is great news for debt repayment. If the opposite is true, you have a negative cash flow, which means you’re spending more than you’re earning.

To calculate your cash flow, use this formula:

Positive cash flow means you have extra money each month that can be directed toward paying down debt or building savings. Negative cash flow, on the other hand, is a sign that you need to either increase your income or reduce your expenses to avoid falling further into debt.

Building a Budget:

Budgeting is an essential tool for managing cash flow and allocating funds toward debt repayment. There are many budgeting methods to choose from, but here are two of the most popular:

- 50/30/20 Rule: This budgeting method suggests allocating 50% of your income to needs (rent, utilities, groceries), 30% to wants (dining out, entertainment), and 20% to savings and debt repayment. It’s a simple, straightforward approach that works well for many people.

- Zero-Based Budgeting: With zero-based budgeting, every dollar has a purpose. This method requires you to assign each dollar of your income to a specific category—whether it’s debt repayment, savings, or daily expenses—until you have “zero” dollars left unallocated. This method is excellent for people who want to track every detail of their spending.

6. Setting Financial Priorities

Choosing Your Debt Repayment Strategy:

Now that you have a clear picture of your finances, it’s time to prioritize your debt repayment. There are two popular strategies for paying down debt: the debt snowball and the debt avalanche methods.

Debt Snowball Method:

This method involves paying off your smallest debts first while making minimum payments on the larger ones. Once the smallest debt is paid off, you move on to the next smallest, creating a “snowball” effect as you build momentum. The advantage of this method is psychological—it gives you quick wins, which can motivate you to keep going.Debt Avalanche Method:

The debt avalanche method focuses on paying off debts with the highest interest rates first, which saves you money in the long run. While it might take longer to see results, this method is financially more efficient because it minimizes the amount of interest you’ll pay over time.

Planning for the Future:

Beyond just paying off debt, it’s important to set long-term financial goals. These might include building an emergency fund, saving for retirement, or even planning for a major life event like buying a home. Having these goals in mind will keep you motivated and give you something to work toward once your debt is under control.

7. Monitoring and Adjusting Your Finances

Importance of Ongoing Financial Monitoring:

Assessing your financial situation isn’t a one-time task—it’s an ongoing process. Life circumstances change, income fluctuates, and expenses can creep up unexpectedly. To stay on track with your debt repayment plan and overall financial health, it’s crucial to monitor your finances regularly. This doesn’t mean obsessing over every dollar, but rather developing a habit of checking in with your financial situation at least once a month.

Financial monitoring helps ensure you’re staying within your budget, keeping up with debt payments, and moving toward your goals. It also allows you to identify potential problems early, such as a rise in interest rates, unexpected bills, or overspending in certain categories.

How to Track Progress:

There are a few key areas to focus on when tracking your financial progress:

- Debt Reduction: Track how much debt you’ve paid off each month. This can be incredibly motivating, especially if you use the debt snowball method, where you’ll see debts disappear over time.

- Savings Growth: If part of your plan involves building an emergency fund or saving for future goals, make sure to track your savings as well. Watching your savings account grow while your debt shrinks will reinforce your commitment to financial health.

- Spending Trends: Review your monthly spending to ensure you’re sticking to your budget. Look for patterns in discretionary spending that may need adjusting. This could be as simple as limiting dining out or cutting back on impulse buys.

- Credit Score Improvement: As you reduce debt and maintain on-time payments, your credit score should improve. Keep an eye on this metric, as a higher credit score can save you money on future interest rates and make it easier to qualify for financial products like mortgages.

By staying vigilant, you’ll maintain control over your finances and make adjustments as needed to avoid falling back into debt. If something unexpected comes up—a job loss, medical emergency, or major expense—you’ll be better equipped to handle it if you’ve been consistently monitoring your finances.

Tools for Monitoring:

There are numerous tools available to help with financial tracking. Apps like Mint, YNAB (You Need a Budget), and Personal Capital are excellent options for keeping track of your budget, monitoring your debt, and visualizing your financial goals. Most of these apps allow you to sync your bank accounts and credit cards, so you can view your entire financial picture in one place. Alternatively, a simple spreadsheet can do the job if you prefer a more hands-on approach.

8. Maintaining Motivation and Accountability

The Challenge of Staying Motivated:

Debt repayment can be a long and often difficult process, especially if your debt is substantial. There will be times when it feels like you’re not making progress, or when other financial goals may seem more appealing than sticking to your debt repayment plan. Staying motivated throughout the journey is one of the biggest challenges people face.

The key to maintaining motivation is to celebrate the small victories along the way. Paying off a single debt, even if it’s small, is a big achievement. Setting short-term milestones and rewarding yourself in healthy, budget-conscious ways can help keep you focused and energized.

Creating Milestones and Rewards:

To keep yourself motivated, break your overall goal into smaller milestones. For example, if you have $20,000 in debt, your first milestone could be paying off the first $5,000. Once you hit that milestone, reward yourself. The reward doesn’t need to be expensive or extravagant—it could be as simple as treating yourself to a night out, taking a day off work to relax, or buying something small that you’ve been wanting.

This method of setting goals and attaching rewards is known as gamification—the process of turning a challenging task into a game-like experience with incentives. It can make the long process of debt repayment feel more manageable and enjoyable.

Accountability Strategies:

Holding yourself accountable is another powerful motivator. Here are a few strategies that can help:

- Debt Repayment Partners: Find a friend, family member, or even an online community where you can share your debt repayment journey. Checking in with someone who knows your goals can help keep you on track and provide a support system when things get tough.

- Visual Progress Tools: Use visual aids to track your debt repayment. Some people find it helpful to create a debt repayment chart where they color in sections as they pay off their debt. Seeing your progress visually can give you a tangible sense of accomplishment.

- Public Accountability: If you’re comfortable with it, consider making your debt repayment goal public. Sharing your progress on social media or with a group can increase your sense of responsibility and push you to stay consistent with your payments.

Dealing with Setbacks:

Setbacks are inevitable. You might have an unexpected expense or a bad month where you can’t make as much progress as planned. The important thing is not to let these setbacks derail your efforts. Acknowledge them, reassess your situation, and get back on track as soon as possible.

Maintaining a growth mindset is critical here. Instead of viewing setbacks as failures, see them as learning opportunities. What caused the setback? How can you prepare for similar situations in the future? By staying focused and maintaining a positive attitude, you can overcome these obstacles and continue moving toward your goal.

With the second Part of this mini series is now behind you, you’ve laid the groundwork for a more informed and strategic approach to tackling your debt. You’ve assessed your financial situation, learned the importance of regular monitoring, and developed strategies for staying motivated. These steps form the foundation of a sustainable debt repayment journey.

“In the next Part of this miniseries, we’ll go through creating a realistic budget and debt repayment plan”

Remember, being in debt is not a life sentence. By gaining awareness and taking the first steps toward managing your debt, you’re already on the path to financial recovery. It takes time, but with the right mindset and strategies, you can break free from the burden of debt.

For more personalized support on your debt-free journey, check out our wealth coaching services. You can also book a consultation to discuss your specific situation and start creating a tailored plan to get out of debt.